In today’s rapidly evolving digital landscape, the shift towards convenient and efficient payment methods is more prevalent than ever. Direct deposit, a popular form of payment, offers a seamless way for individuals to receive their earnings directly into their bank accounts. As we look ahead to 2024, understanding the eligibility criteria for unlocking the benefits of direct deposit is crucial. Join us as we explore the requirements and qualifications necessary to embrace this modern payment method in the upcoming year.

Understanding Direct Deposit and Its Benefits

Direct deposit is a convenient and secure way to receive payments directly into your bank account without the hassle of paper checks. By setting up direct deposit, you can enjoy a variety of benefits that make managing your finances easier and more efficient. Here are some key advantages of utilizing direct deposit:

- Quicker access to funds: With direct deposit, you can get paid faster as your money is deposited directly into your account on payday without any delays.

- Convenience: Say goodbye to the hassle of having to physically deposit or cash checks – direct deposit saves you time and effort.

- Security: Eliminate the risk of lost or stolen checks by receiving payments securely into your bank account.

| Name | Eligibility Criteria |

|---|---|

| Employees | Employed by an organization that offers direct deposit as a payment option |

| Government Benefits | Eligible for benefits such as Social Security, Medicare, or unemployment compensation |

Eligibility Criteria for Direct Deposit

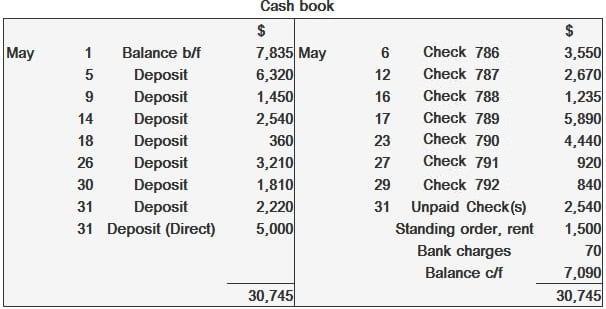

When it comes to setting up direct deposit for your payments, there are certain eligibility criteria that need to be met in order to ensure a smooth and efficient process. To be eligible for direct deposit, individuals must meet the following requirements:

- Must have a valid bank account in their name

- Must have a steady source of income or be receiving payments from an eligible program

- Must provide accurate and up-to-date banking information to the payer

It is important to note that not all payment recipients may qualify for direct deposit, so it is crucial to review the specific eligibility criteria established by the payer. By meeting these requirements, individuals can enjoy the convenience and security of having their payments deposited directly into their bank account.

Assessing Payment Options for 2024

When considering the best payment option for 2024, it is essential to understand the eligibility criteria for unlocking direct deposit. Direct deposit offers a convenient and secure way to receive payments, but not everyone may qualify. To determine if you are eligible for direct deposit in 2024, consider the following criteria:

- Must have a valid bank account

- Provide accurate banking information

- Ensure your financial institution supports direct deposit

By meeting these requirements, you can streamline your payment process for 2024 and enjoy the benefits of direct deposit. Take the time to assess your eligibility and unlock the convenience of direct deposit for the upcoming year.

Recommendations for Optimizing Direct Deposit Access

To optimize direct deposit access in 2024, it is crucial to ensure that payment eligibility criteria are met. One key recommendation is to streamline the application process for direct deposit by making it more user-friendly and accessible to all individuals. This can be achieved by developing a clear and concise set of eligibility requirements that are easy to understand and meet. Additionally, providing educational resources and support for those who may not initially qualify can help increase participation in direct deposit programs.

Another recommendation for optimizing direct deposit access is to implement secure verification processes to protect sensitive payment information. Utilizing multi-factor authentication and encryption technologies can help safeguard personal data and prevent fraudulent activity. Additionally, conducting regular audits and assessments of payment systems can help identify any potential vulnerabilities and address them promptly. By prioritizing security and user-friendly design, direct deposit programs can effectively serve a wider range of individuals and provide a convenient and reliable payment option for all. As we look forward to the year 2024, it is important to understand the eligibility criteria for unlocking direct deposit payments. By meeting the specified requirements, individuals can enjoy the convenience and security of having their payments directly deposited into their bank accounts. Stay informed and prepared to make the most of this payment option in the coming years. Thank you for reading and may you benefit from the ease and efficiency of direct deposit.