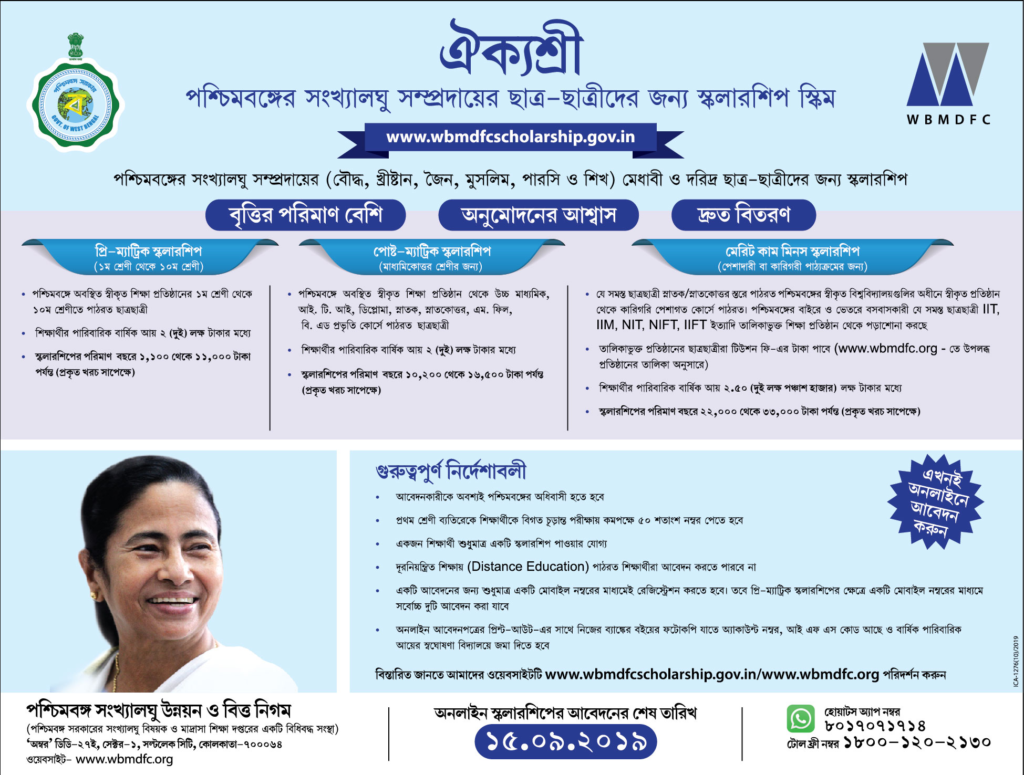

To meet the rising demand for education among minority communities in West Bengal, the State Government of West Bengal has taken a significant step. They have initiated the “Aikyashree” program, also known as wbmdfc scholarship.

wbmdfc scholarship program aims to support deserving students from minority backgrounds in their pursuit of education and brighter futures.

WBMDFC Scholarship Eligibility Criteria

For all the scholarships, it is necessary to have a West Bengal domicile.The rest of the criterias are different –

West Bengal Pre-Matric Scheme

- For Class I to X pupils.

- Must study in a recognized School/Institution under State/Central educational bodies.

West Bengal Post Matric Scheme

- Students from Class XI to Ph.D can apply for this scholarship.

- Must study in a recognized School/Institution under State/Central educational bodies.

West Bengal Merit Cum Means

- Scholarship for professional/technical courses at ug and pg levels.

West Bengal Talent Support Stipend

- Stipend for students who passed the last exam with less than 50% marks, studying from Class XI to Ph.D. (except professional/technical courses).

Swami Vivekananda Merit Cum Means Scholarship for Minorities

- Applicants must be pursuing their education in recognized institutions within West Bengal.

- Students should have completed their studies in the current academic year from institutions affiliated/accredited with WBBSE, WBCHSE, WBBME, or any state university.

- Minimum academic requirements: 75% from Higher Secondary to Graduate level, 53% for Postgraduate level, 55% for engineering students at the Graduate level, and 45% for K3-Kanyashree.

West Bengal Term Loan Scheme

The West Bengal Minorities’ Development & Finance Corporation offers term loans up to Rs. 5 lakhs to individuals from notified minority communities. Repayment is at a 6% interest rate, divided into 12 or 20 equal quarterly installments over 3 or 5 years.

Eligibility Criteria:

- Annual family income must be upto Rs. 98k (rural areas) and Rs. 1 lakh 20 thousand for urban areas.

- Guarantors are required for loans exceeding Rs. 40,000.

- For loans between Rs. 40,001 and Rs. 50,000, a taxpayer or professionally qualified person (e.g., Doctor, Engineer) is needed.

- For loans above Rs. 50,000, a successful beneficiary of WBMDFC can be a guarantor.

- Applicants must be between 18 to 50 years of age.

- A savings bank account is mandatory.

West Bengal Micro Finance (Directly to SHGs)

Each member of a SHG can receive loans of up to Rs. 1 lakh. The repayment period is set at 24 months, with an interest rate of 7% per annum.

Eligibility Criteria:

- Self Help Groups composed of 10-20 Minority Women are eligible for loans under this scheme.

- Annual family income must be upto Rs. 98k (rural areas) and Rs. 1 lakh 20 thousand for urban areas.

- At least 60% of SHG members should be from Minority communities.

West Bengal Minority Women Empowerment Programme

These loans come with a low-interest rate of 3%. Additionally, the beneficiary is eligible for a subsidy equal to 50% of the loan amount, up to a maximum of Rs. 15,000.

This program is designed to empower Minority women by providing them with financial resources to establish and grow their businesses.

West Bengal Educational Loan

The West Bengal Educational Loan program offers financial support to students pursuing professional courses such as Medical, Engineering, Management, Nursing, Law, and more.

- Loan Amount: You can apply for a maximum of Rs. 20 lakhs for studies within India and up to Rs. 30 lakhs if you want to study in foreign.

- Repayment of the loan is required with an interest rate of 3%, and it begins in installments after 6 months from the completion of the course or upon gaining employment, whichever happens earlier.

Eligibility Criteria:

- The annual family income must be up to Rs. 1,20,000 for urban areas and Rs. 98k for rural areas.

- The age of the applicants must be from 16 to 32 years.

Scholarship Application Process

To apply for scholarships, you can obtain application forms.

Term Loan Application

Application forms for term loans can be acquired from the Minority office situated in the office of the District Magistrate, Sub Divisional Officer (S.D.O.), or Block Development Officer (B.D.O.).

Micro Finance (Directly to SHGs)

For Micro Finance, submit your application using the prescribed format provided by the Corporation.

Minority Women Empowerment Programme

To apply for the Minority Women Empowerment Programme, complete the application form provided by the Corporation.

Educational Loan

You can apply for an educational loan online by visiting www.wbmdfc.net. This convenient online platform allows you to submit your application with ease.

Merit-cum-Means Scholarship

To apply for this scholarship, you should submit an online application through www.wbmdfcscholarship.gov.in. The application window typically opens from June to August each year.

Pre-Matric Scholarship and Post Matric Scholarship

The application process is as follows:

- File your application online via www.wbmdfcscholarship.gov.in. Generally, online applications are accepted from June to August each year.

- After completing the online application, you should submit a hard copy of the filled-in application form at your respective institute. This submission should include:

- An income certificate.

- A self-attested copy of the Bank Pass Book of the applicant or jointly with the parents.

Talent Support Stipend

- Submit your application via the portal www.wbmdfcscholarship.gov.in. Applications are generally accepted from June to September each year.

- After filling out the online application, provide its hard copy with:

- A mark sheet copy of the last examination.

- An income certificate.

- A copy of the Bank Pass Book to the concerned Institute.

Swami Vivekananda Merit cum Means Scholarship

Aikyashree Scholarship Documents Required

To apply for WBMDFC Scholarships, you will typically need the following documents:

- Minority Certificate

- Marksheets: Copies of marksheets from your qualifying examinations are essential to demonstrate your academic performance.

- Family Annual Income Certificate: Provide a certificate that states your family’s annual income. This helps determine your eligibility for specific scholarships.

- Domicile of West Bengal Certificate:

- Aadhaar Card Photocopy

- Bank Details: You will need a copy of your bank statement or passbook, which includes your account number and IFSC code.

- Recent Photograph

Aikyashree program Rewards

The scholarship amounts awarded to minority scholars for an academic year are as follows.

For Day Scholars

- For students in classes I to V: INR 1,100

- For students in classes VI to X: INR 5,500

- For students in classes XI and XII: INR 10,200

- For students in XI/XII pursuing Technical & Vocational Courses: INR 13,500

- For Undergraduate (UG) and Postgraduate (PG) level students: INR 6,600

- For M. Phil students: INR 9,300

- For Merit Cum Means scholars: INR 27,500

For Hostelers

- For students in classes VI to X: INR 11,000

- For students in classes XI and XII: INR 11,900

- For students in XI/XII pursuing Technical & Vocational Courses: INR 15,200

- For Undergraduate (UG) and Postgraduate (PG) level students: INR 9,600

- For M. Phil students: INR 16,500

- For Merit Cum Means scholars: INR 33k.

Aikyashree Terms and Conditions

When applying for WBMDFC scholarships, applicants are required to adhere to the following terms and conditions:

- Provide a family income certificate as part of their application.

- For renewal applicants, the continuation of the scholarship will depend on securing a minimum of 50% marks in the previous year’s examination.

- Selected candidates are expected to maintain regular attendance.

- If a student violates the school’s discipline or any other terms and conditions of the scholarship, their scholarship may be suspended or cancelled.

- If it is found out that the candidate has received a scholarship through fraudulent means, their scholarship will be cancelled immediately, and the amount already paid as a scholarship will be recovered.

Note = Before applying for the scholarship, also refer to the official guidelines and check the eligibility criteria and other details like the reward amount, etc. from there too.