In the land of majestic mountains, bustling cities, and winding scenic roads, Washington State truly offers a driver’s paradise. But as you embark on your automotive adventures, there’s one crucial aspect that deserves your undivided attention – automobile insurance. Fear not, fellow road warriors! In this ultimate guide, we will navigate the intricate labyrinth of Washington State’s automobile insurance, equipping you with the knowledge required to protect both yourself and your cherished set of wheels. So buckle up, adjust your rearview mirror, and let us embark on a journey through the captivating realm of automobile insurance in the Evergreen State.

Getting Familiar with Automobile Insurance Requirements in Washington State

Automobile Insurance Requirements in Washington State

Understanding the automobile insurance requirements in Washington State is crucial for every driver. Whether you’re a new resident or a seasoned local, it’s important to stay up-to-date with the regulations to ensure you’re adequately covered on the road. Here is a comprehensive guide that will help you navigate the ins and outs of automobile insurance in the Evergreen State.

Liability Coverage

In Washington State, liability coverage is mandatory for all drivers. This coverage protects you financially in case you cause an accident and are found liable for the damages. The minimum liability coverage required in Washington State is as follows:

- Bodily Injury Liability: $25,000 per person

- Bodily Injury Liability: $50,000 per accident

- Property Damage Liability: $10,000

Uninsured/Underinsured Motorist Coverage

In addition to liability coverage, Washington State also requires uninsured/underinsured motorist (UM/UIM) coverage. This coverage protects you if you are involved in an accident with a driver who either doesn’t have insurance or doesn’t have enough insurance to cover the damages. The minimum UM/UIM coverage required in Washington State is the same as the minimum liability coverage:

- Bodily Injury Liability: $25,000 per person

- Bodily Injury Liability: $50,000 per accident

- Property Damage Liability: $10,000

Exploring Key Coverage Options for Automobile Insurance in Washington State

When it comes to automobile insurance in Washington State, understanding the various coverage options available can save you both time and money in the long run. Whether you’re a seasoned driver or a first-time car owner, it’s important to know which policies are required by state law and which ones offer additional protection for you and your vehicle.

First and foremost, liability coverage is mandatory in Washington State. This type of insurance helps protect you financially in case you cause injury or property damage to others in an accident. It includes bodily injury liability, which covers medical expenses and lost wages for the injured party, as well as property damage liability that pays for repairs or replacements of damaged property.

Aside from liability coverage, there are other options to consider based on your needs and budget. Collision coverage, for example, helps cover the cost of repairing or replacing your vehicle if it’s damaged in a collision, regardless of who is at fault. Comprehensive coverage, on the other hand, protects against non-collision related damages such as theft, vandalism, or natural disasters.

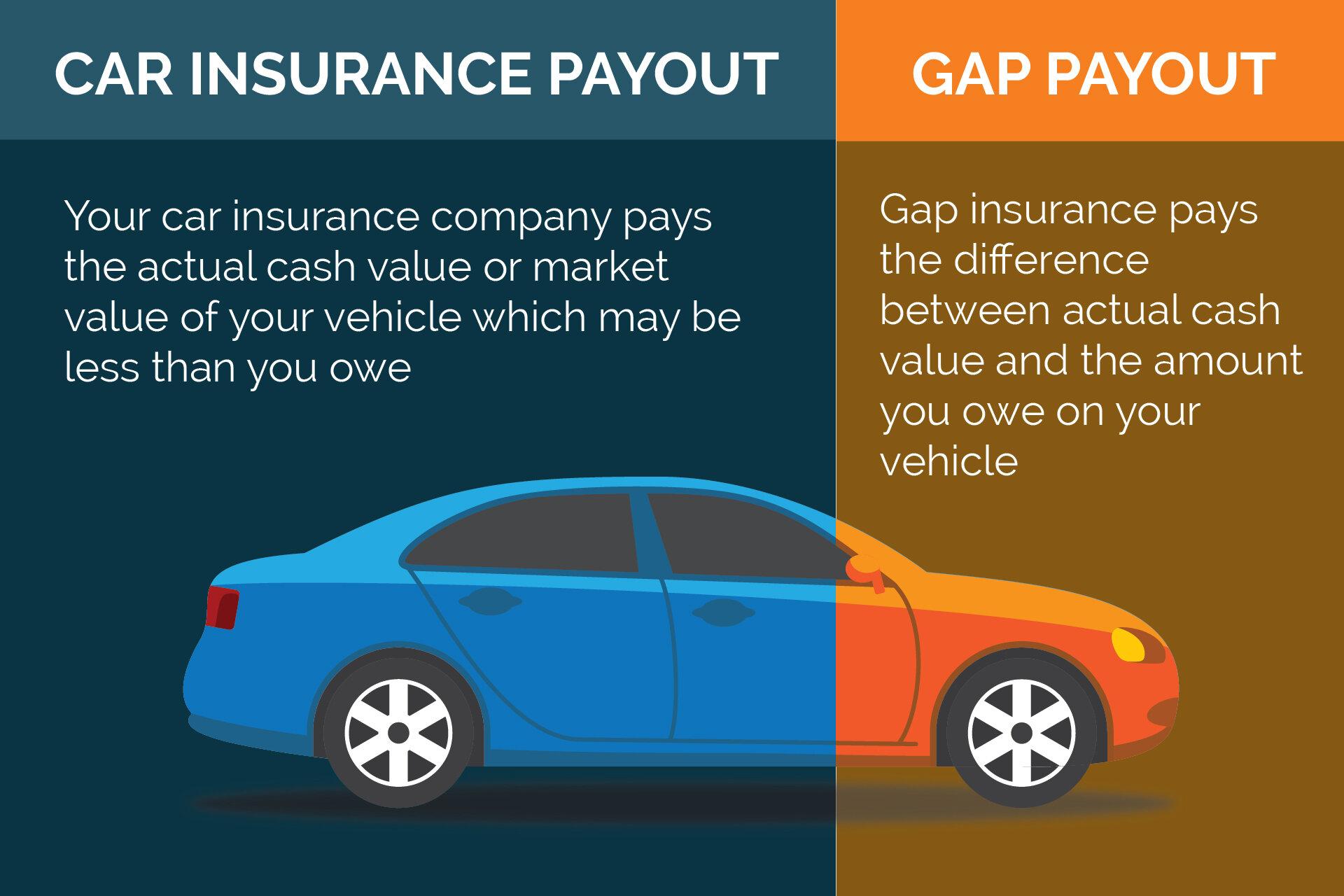

Furthermore, uninsured/underinsured motorist coverage can provide additional security by compensating for your injuries or damages caused by a driver who either doesn’t have insurance or doesn’t have sufficient coverage. Medical payments coverage, roadside assistance, rental car reimbursement, and gap insurance are also worth exploring, as they can offer extra peace of mind in various situations.

Tips for Navigating the Claims Process in Washington State Automobile Insurance

Once you have automobile insurance in Washington State, it’s essential to know how to navigate the claims process smoothly. We’ve gathered some valuable tips to help you tackle the sometimes daunting task of filing a claim and obtaining the compensation you’re entitled to.

1. Report the Accident Promptly: As soon as possible after an accident, make sure to report it to your insurance company. This step is crucial, as delay may lead to difficulties in the claims process.

2. Document and Preserve Evidence: Gather all relevant evidence from the accident scene, such as photographs, witness statements, and police reports. This evidence will help support your claim and provide a clear picture of the incident.

3. Understand Your Policy: Familiarize yourself with the terms, limits, and coverage provided by your automobile insurance policy. Knowing your policy well will ensure you are aware of what expenses are covered, any deductibles, and any limitations or exclusions.

4. Communicate Effectively: Maintain open and clear communication with your insurance company. Promptly respond to any requests for information or documentation, and update them on any changes in the process or your condition.

| Claim Documents Checklist | Status |

|---|---|

| Accident Report | Submitted |

| Medical Records | In Progress |

| Witness Statements | Received |

| Repair Estimates | Pending |

5. Keep Track of Your Expenses: Maintain detailed records of all expenses related to the accident, including medical bills, vehicle repairs, car rental costs, and any other out-of-pocket expenses. This documentation will help substantiate your claim.

6. Seek Legal Advice if Necessary: If your claim becomes complex, disputed, or you encounter challenges during the process, it may be wise to consult with an experienced automobile insurance attorney who can guide you through the legal aspects.

Finding the Best Automobile Insurance Provider in Washington State

When it comes to , there are a few key factors to consider. First and foremost, you want a provider that offers comprehensive coverage and reliable customer service. Look for a company that has a solid reputation and positive reviews from other drivers in the area. It’s also important to consider the cost of coverage. While you don’t want to sacrifice quality for a cheaper premium, it’s always a good idea to shop around and compare quotes from different providers to ensure you’re getting the best deal.

Another important aspect to consider is the range of coverage options offered by the insurance provider. You want to choose a company that offers flexibility and allows you to customize your policy based on your specific needs and budget. Look for providers that offer a variety of coverage types, including liability, collision, and comprehensive. Additionally, it’s worth considering any additional benefits or discounts that may be available, such as safe driver discounts or multi-policy discounts.

As we steer towards the end of this ultimate guide, we hope to have ignited a newfound understanding and clarity when it comes to navigating the intricate world of automobile insurance in Washington State. From the bustling streets of Seattle to the serene valleys of Spokane, it is imperative to equip oneself with the knowledge and tools necessary to protect not only our vehicles but also the financial well-being of ourselves and our loved ones.

By now, you have delved deep into the fundamental aspects of auto insurance, deciphered the perplexing jargon, and embarked on a journey to unearth the most suitable coverage options for your needs. Whether you are a seasoned driver or a fresh-faced newcomer to the bustling roads of Washington, this guide was meticulously crafted to offer you a comprehensive roadmap through the labyrinthine corridors of auto insurance.

As the gears of time turn, remember that the insurance landscape is a perpetually changing terrain, influenced by legislation, innovation, and the unpredictable nature of the ever-evolving world we inhabit. So, it is in your best interest to periodically revisit this guide or continue seeking expert advice to stay up-to-date with the latest trends and adjustments that may impact your insurance policies.

In a state teeming with breathtaking landscapes and buzzing highways, never underestimate the peace of mind that an ironclad insurance policy can bestow. From the soaring peaks of Mount Rainier to the charming coastal highways, every turn demands your diligence and protection. By arming yourself with knowledge, understanding your rights and obligations, and working in harmony with a reliable insurance provider, you can navigate the intricate tapestry of Washington’s auto insurance world with confidence and serenity.

So, as you buckle up and embark on new adventures across the Evergreen State, remember that this guide shall remain a steadfast companion, waiting to be consulted should doubts arise. From the options of liability coverage to Personal Injury Protection, from the intricacies of uninsured motorist insurance to the nuances of comprehensive coverage, you are now empowered to traverse the highways, knowing that you possess the tools necessary to safeguard yourself and your cherished assets.

As we part ways for now, our humble hope is that this ultimate guide has shed light on the lesser-known corners of automobile insurance in Washington State, making your journey smoother, your decisions wiser, and your peace of mind unyielding. May the roads ahead be paved with assurance and protection, as you embark on an exciting voyage through the scenic byways of Washington, secure in the knowledge that you are well equipped to navigate any bumps that come your way.

Bon voyage!