Link Intime IPO Allotment Status: Link Intime may review DCX IPO Allotment significance, period, and registration process from the respectable app of your Stock Market trading.

Investors anxiously anticipate acknowledging the percentage allowance popularity after believing that the bidding for DCX Systems Ltd. is the main social presentation on Wednesday, November 2nd.

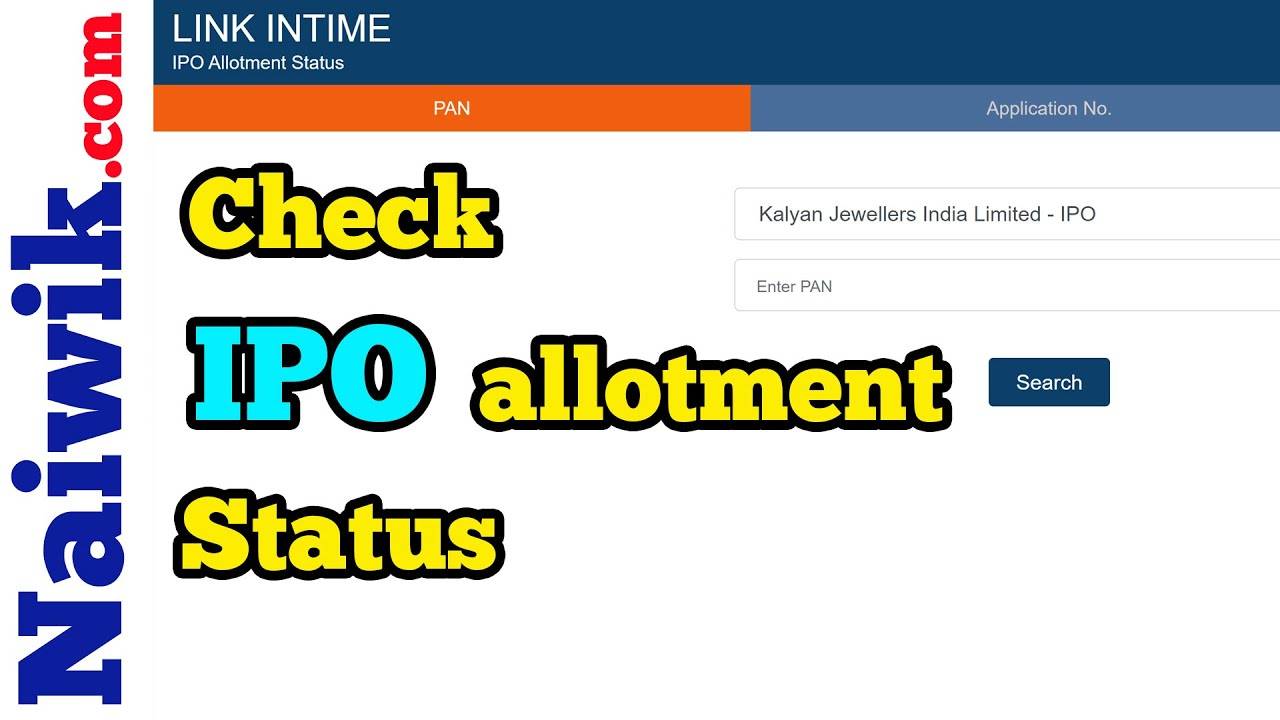

Link Intime Ipo Allotment Status

The proportion DCX Systems IPO allowance situation can also additionally turn out to be social on November 7th.

Bidding people will then be able to see the allotment reputation online. DCX Systems’ IPO garnered 69.79 models as numerous registrations on the ultimate day of the subscription procedure.

Respecting the grey market premium, in line with marketplace watchers, commodities of DCX Systems at the moment are being purchased and sold at a prime degree of Rs. 74, in stride with an article through LiveMint.

This article will offer the info you need approximately the DCX Systems IPO revenue Status.

More information From NSE Data

According to NSE’s data, IPO gave the initial social payment for DCX Systems proposals for 101.27 crore stocks, however handiest 1. forty-five crore stocks had been to be had for assets.

The stocks isolated for the class of QIBs acquired a registration charge of 84.32 instances. The component isolate for RIIs acquired a subscription charge of 61.

seventy-seven instances. The dilemma for buyers no longer related to an organization becomes met 43. ninety-seven instances over.

The DCX

The IPO allowance process can also additionally get finalized on November 7th. On the opposite arrow, the firm’s stocks get indexed on inventory trades together with BSE and NSE on November 11, 2022.

Previously, the reputation of the percentage allotment for DCX Systems IPO was given declared.

Buyers can confirm it online via way of getting on to the good internet site of BSE or the internet site of the registrar of the IPO, that’s LinkIntime India Private Ltd.