When somebody is thinking of making his or her own house but bad credits are taking away most of their wishes, the credits are literally stopping them from fulfilling their dreams, then the topic of Nxxxxs Subprime Mortgage Rates becomes relevant in that context.

It is true that these types of mortgages do leave the chances of high risks, but it is also essential to know the dos and don’ts when somebody is on the way to make his or her approach to this. Let’s find out the innate details that are associated with this type of mortgage.

Who are the borrowers of Nxxxxs Subprime Mortgage Rates?

Mortgage borrowers here satisfy a particular type of criteria. And these Criteria make them eligible to be on this path. The mortgage applicants have to hold Very poor credit scores, as well as the absolutely negative items in their credit reports, are being considered as the subprime.

On the other hand, we see that prime borrowers have a good credit score. These people also have a very strong financial track record. This entails the lender getting the interest at a very low rate.

Which is any day a good sign for all the lenders out there, their previous track record makes the most for their career. A subprime borrower is one who holds a credit score between 660 or even less.

There are many more features that create a broad idea on how to identify a subprime mortgage borrower. Which are quite like this-

- Somebody who eventually had at least two payments late by 30days in the corresponding last 12 months. Another thing which is important here as well, this gets applied to somebody who also had at least one payment late by 60 days in the last 24 months.

- Had to go through the judgements of foreclosure,repossession or at least charge off by the deadline of 24 months.

- This part is most important, if the person had been charged or accused of bankruptcy. In that case this particular criteria gets applied, and that too leaves some significant impacts.

- Had been holding the Debt to income ratio for at least 50%, is another criteria that makes a borrower a Nxxxxs Subprime Mortgage Rates.

These are the reasons that work in the place of having home loans and these are the main things that also work for the notion of Nxxxxs Subprime Mortgage Rates as well.

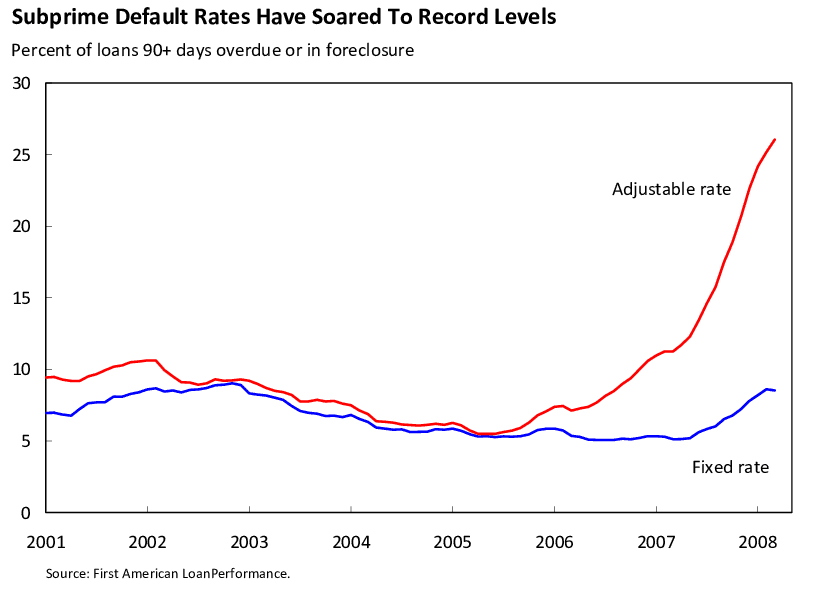

The term subprime mortgage has been introduced to the world of the economy in the year of 2008. Prior to this period, a very low set standard was there in terms of lending loans to the borrowers.

Individuals with poor credit records and reports used to get hold of this. The subsequent financial crisis led them to acquire this conception in detail.

Types of Nxxxxs Subprime Mortgage Rates

Like several other market-available conventional mortgages, there are a lot of variations in the sections of Nxxxxs Subprime Mortgage Rates as well, which includes the furthermore points in the course of describing what are the types and how these all get applied.

Fixed-rate mortgages.

These types of loans tend to create a lot more buzz. Let’s know what are the details of this type, the interest rate of these types of loans are all set for the respective durations of the mortgage and payments happen to be in the same amount in every month of the year.

But unlike a conventional mortgage which holds certain common specifications, as it comes with a repayment term of 15 or 30 years, fixed-rate subprime mortgages can last 40 to 50 years.

So the main difference that we can see here is the time span, the lender gets a lot more time to cover up the entire amount and to get rid of any financial burden.

Adjustable-rate mortgages (ARM).

Instead of bearing the load of one interest rate that remains fixed and static throughout the loan term, as long as the time period stays, that can be a span of 50 years too, a subprime ARM offers a low introductory rate to its lenders that eventually reshuffles according to any popular and trusted market index it’s tied to.

For example, with a 5/1 ARM, the borrower will only have to pay off the very basic introductory rate for the first five years. Once that period gets over, the rate will again reset one or more times during the remaining years, whatever years are left to be completed.

Usually, lenders can decide how much the rate can increase, here the independence of the lenders to make their decision is present.

Interest-only mortgages.

This type entails the lenders about a process like when lenders are paying payments on an interest-only loan, the funds get directed towards only the pre-accredited interest for the first seven to 10 years after availing the loan.

Then payments will eventually go toward paying down principal, the main amount, and interest for the rest of the term as many years it takes to cover up the thing.

Conclusion

Whether or not somebody opts to avail of the Nxxxxs Subprime Mortgage Rates is depending upon the status of the credit, if that’s too poor to be run, then the lender may opt for this.

But again experiences say that govt backed mortgages are any day safer and easier to be paid off. The individual has to think holistically before opting.