Incometaxindiaefiling.gov.in link

Incometaxindiaefiling.gov.in link: The government rules change with time, and so it is very important to work accordingly. Today Aadhar card and PAN card are the most common documents for personal verification, and the current rules say that “PAN card must be linked Aadhar card”. As rules are changing, the government have also moved to a new income tax portal.

The last date to link PAN card with Aadhar card is June 30. Earlier the date was March 31, but looking at the current pandemic income tax department have extended it to June 30. The best part is you are not required to visit any place for linking PAN card with Aadhar as the new portal make it easy to complete the process from the comfort of the home.

How to link PAN card to Aadhar on the new income tax portal?

- The first step to link the PAN with Aadhar visits the site https://www.incometax.gov.in/iec/foportal/.

- There is a list of services offered at this web portal. On the home page, scroll down to the “Our Services” option, where you will find many other options.

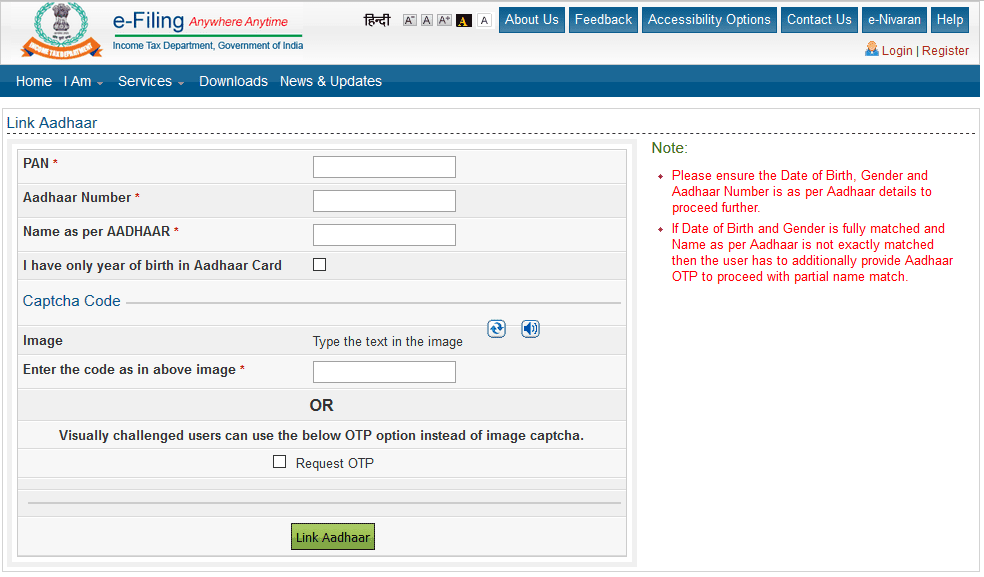

- Among all, click on “Link Aadhar”, and it will redirect to a new window where further details are to be filled.

- The new window will ask to enter some important details like PAN number, Aadhar number, and mobile number. Make sure to enter all the details as available on your cards.

- Click on “I agree to validate my Aadhar details” to continue further. If your Aadhar card only has your birth year, a checkbox is to be checked and click on “Continue”.

- Once all the steps are completed, you will receive a 6-digit OTP in your registered mobile number. Ensure to enter the OTP in the verification page as soon as it is received, as the OTP is valid only for 15 minutes.

- Lastly, click on “Validate”, which will give the pop up saying, “the request to link PAN to your Aadhar card is submitted”.

FAQs

- Why is it essential to link PAN with the Aadhar card?

The government has made it compulsory to link PAN with the Aadhar, and one who fails to do so will face the consequences. The PAN card will become invalid, and one has to pay 1,000 Rs as a penalty. Lastly, they will be required to do the process for reactivation.

- What documents are required to link PAN with Aadhar?

One has to be ready with their PAN card, Aadhar card and also a valid mobile number. The new portal has made it very easy to complete the process without any hindrance, and one can do it by themselves from their home.

Conclusion

So, if you themselves individual or even working as an entity who fills income tax returns and has banking transactions of more than Rs. 50,000 must make sure to link PAN with Aadhar. One who fails to do so will not be able to carry out the transaction or even file the income tax, and so it is better to complete the process before June 30, 2021.